Who’s Profiting Most from AI Agents? Inside CB Insights’ Top 20 Startup Ranking

what did Anysphere discover that billion-dollar tech giants missed? 20 AI agent startups generating billion-dollar revenues, reshaping the rules of value creation, competition, and sustainable growth

Twenty AI companies you've never heard of just proved that software can replace entire departments—and generated $1.3 billion doing it. These aren't futuristic experiments; they're present-day revenue machines commanding 225x valuation multiples while traditional tech giants scramble to catch up.

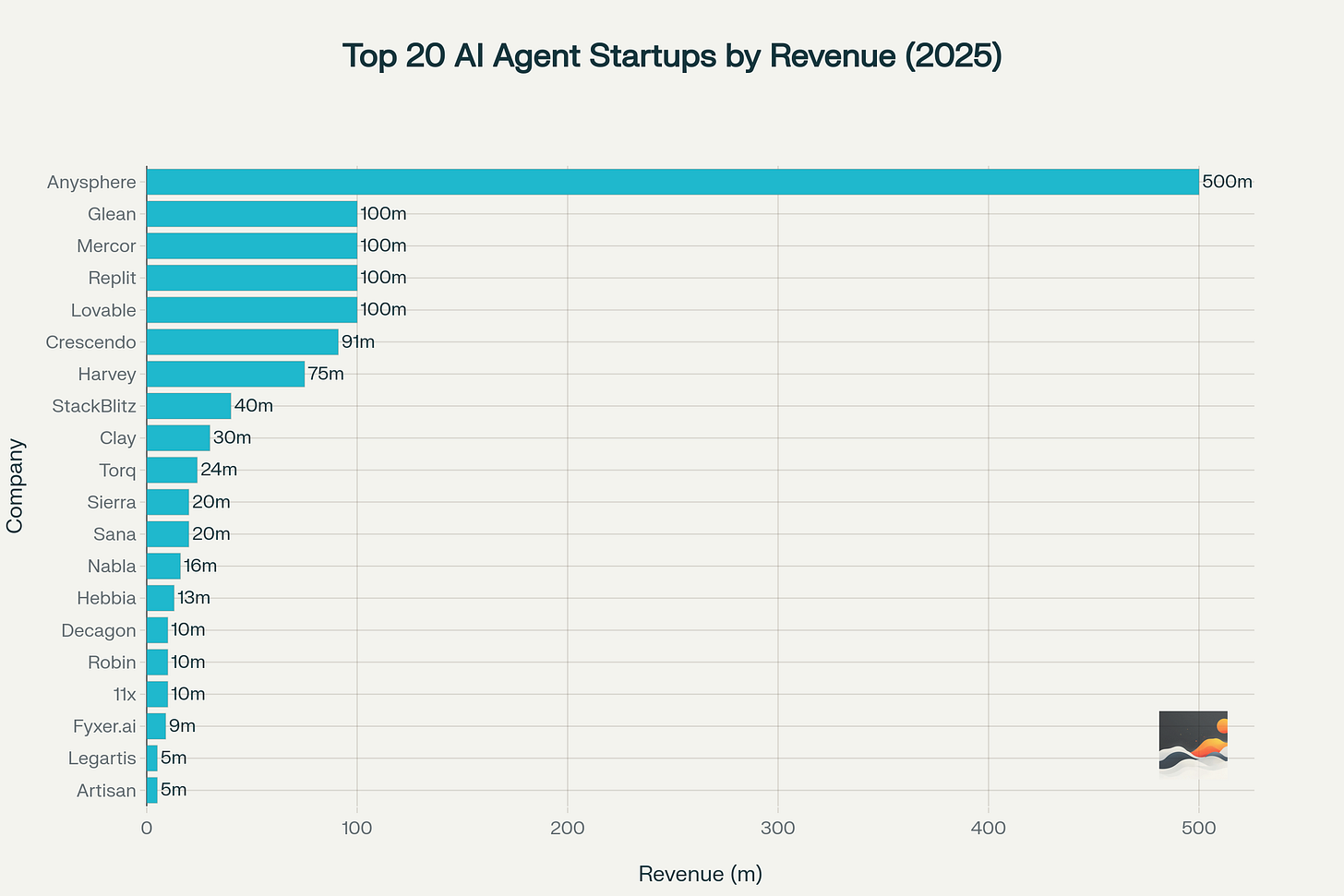

The AI landscape landscape has undergone a seismic transformation, with AI agent startups emerging as the new powerhouse sector commanding unprecedented valuations and revolutionary revenue growth. According to CB Insights' latest revenue ranking, these top 20 AI agent startups collectively generated $1.28 billion in annual revenue, marking a historic milestone that validates the commercial viability of autonomous AI systems. While traditionally these milestones took decades to reach, these barely old companies are making 100s of millions in annual reviews, with Anysphere's Cursor leading the pack with $500 million, representing nearly 40% of the total market share among the top 20 players in various sectors such as enterprise workflows, software development, customer service, and legal applications. So It seems that AI companies are strategically pausing to rebuild their foundation before continuing after slamming at full speed and crossing $100M mark.

The collective $1.28 billion revenue achievement and exponential growth also validates both market demand and technological capability and investor confidence. Each headline leverages psychological hooks like mystery, shocking numbers, impossible speed, and counterintuitive insights to drive curiosity and engagement.

Here are some of the most remarkable—and surprising—stories revealing how new players and unseen strategies are transforming entire industries at record speed:

A 3-Year-Old Company Hits $500M Revenue (And You've Never Heard of It)

Anysphere skyrockets to half a billion in just three years—outpacing tech giants and revolutionizing productivity instead of replacing jobs.Investors Are Paying 225x Revenue for These 'Invisible' AI Companies

AI agent startups like Sierra rewrite the rules of valuation, trading at 225x multiples and outshining even Apple in investor confidence.A Company Founded in Someone's Dorm Makes $4.5 Million Per Employee

Mercor’s ultra-lean HR model stuns the industry by yielding more revenue per employee than even the world’s largest tech and finance firms.$740M in Revenue, Zero Human Programmers, AI coding agents like Anysphere fuel a software boom where autonomous code-writing eclipses anything seen in Silicon Valley.

A wave of new AI startups surges to the top, redefining entrepreneurial speed and market disruption. interesting fact— 40% of These Billion-Dollar Companies Didn't Exist 2 Years Ago

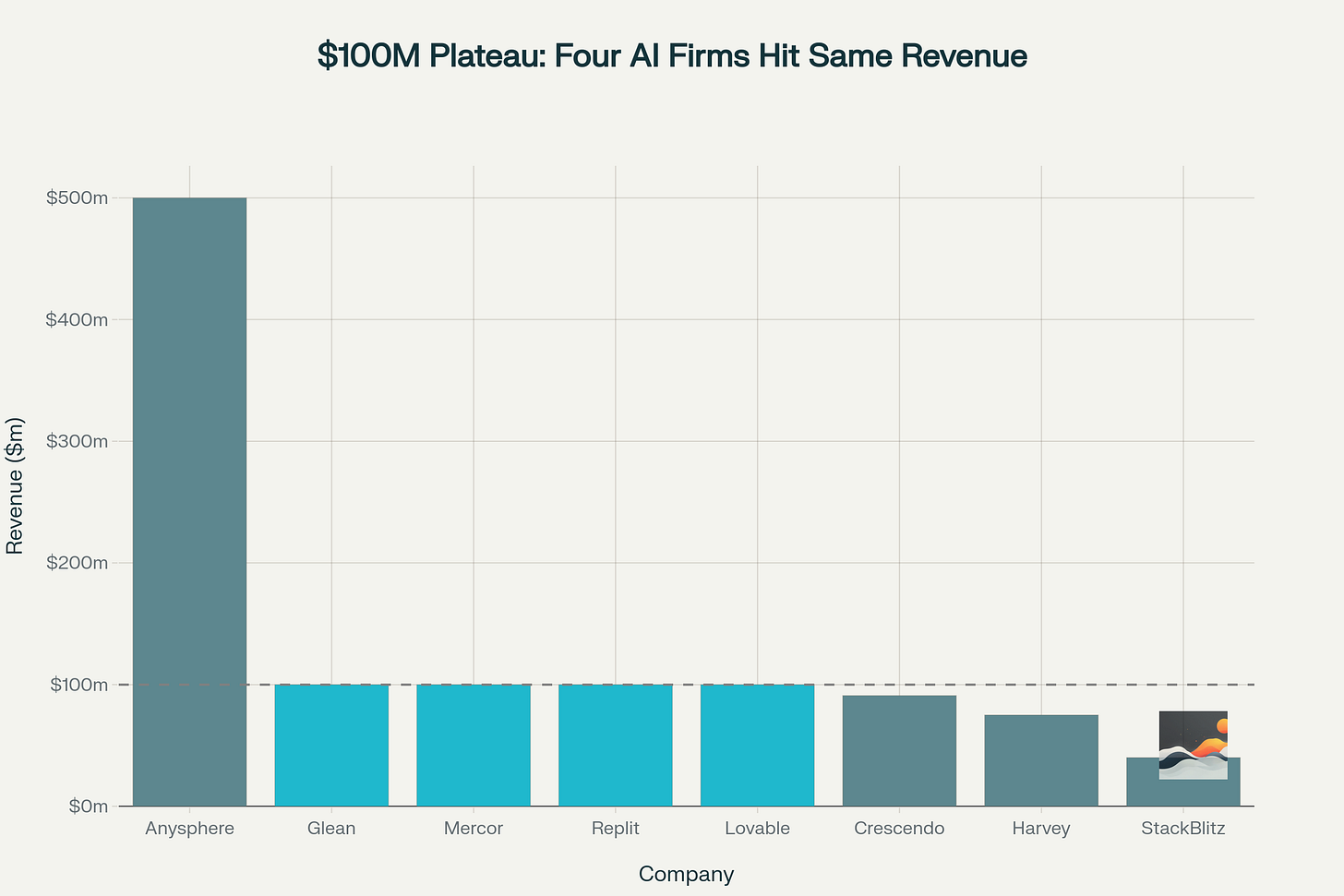

The $100M Mystery: 4 of these distinct AI Companies All Hit the Same Revenue Number revealing a universal law in AI business growth.

A Legal AI Makes $75M Helping Lawyers Do What They Hate Most

Harvey AI capitalizes on lawyers' pain points, turning tedious legal work into a $75 million business serving hundreds of elite firms.

The era of AI agents as a fringe experiment is over— they are now a core force driving business transformation. The AI agent sector is maturing at record speed, with its leaders showcasing how quickly startups are capitalizing on generative AI’s potential and Industry pioneers like Anysphere, Harvey, and Glean pulling ahead with expertise and strong customer loyalty, yet the market faces growing pains including profitability, talent shortages, and potential consolidation. As AI agents become integral to enterprise tech and the market heads toward $13 billion by year’s end, those who deliver sustainable value through disciplined economics, technical strength, and meaningful differentiation may just be the win this battle.

Here is the full breakdown.

Company Formation Timeline and Growth Velocity

The temporal analysis of company formation reveals 2023 as the peak founding year, with six companies (30% of the top 20) established during this period. This surge corresponds directly with the ChatGPT launch and subsequent generative AI adoption wave, demonstrating how quickly entrepreneurs capitalized on emerging market opportunities.

This acceleration timeline represents a fundamental shift in startup development cycles. Traditional software companies typically required 5-7 years to reach $100 million in annual recurring revenue, while leading AI agent startups achieve this milestone in 12-24 months. Cursor exemplifies this phenomenon, increasing its annual recurring revenue from $1 million to $500 million in just over a year, making it the fastest-growing SaaS company in history

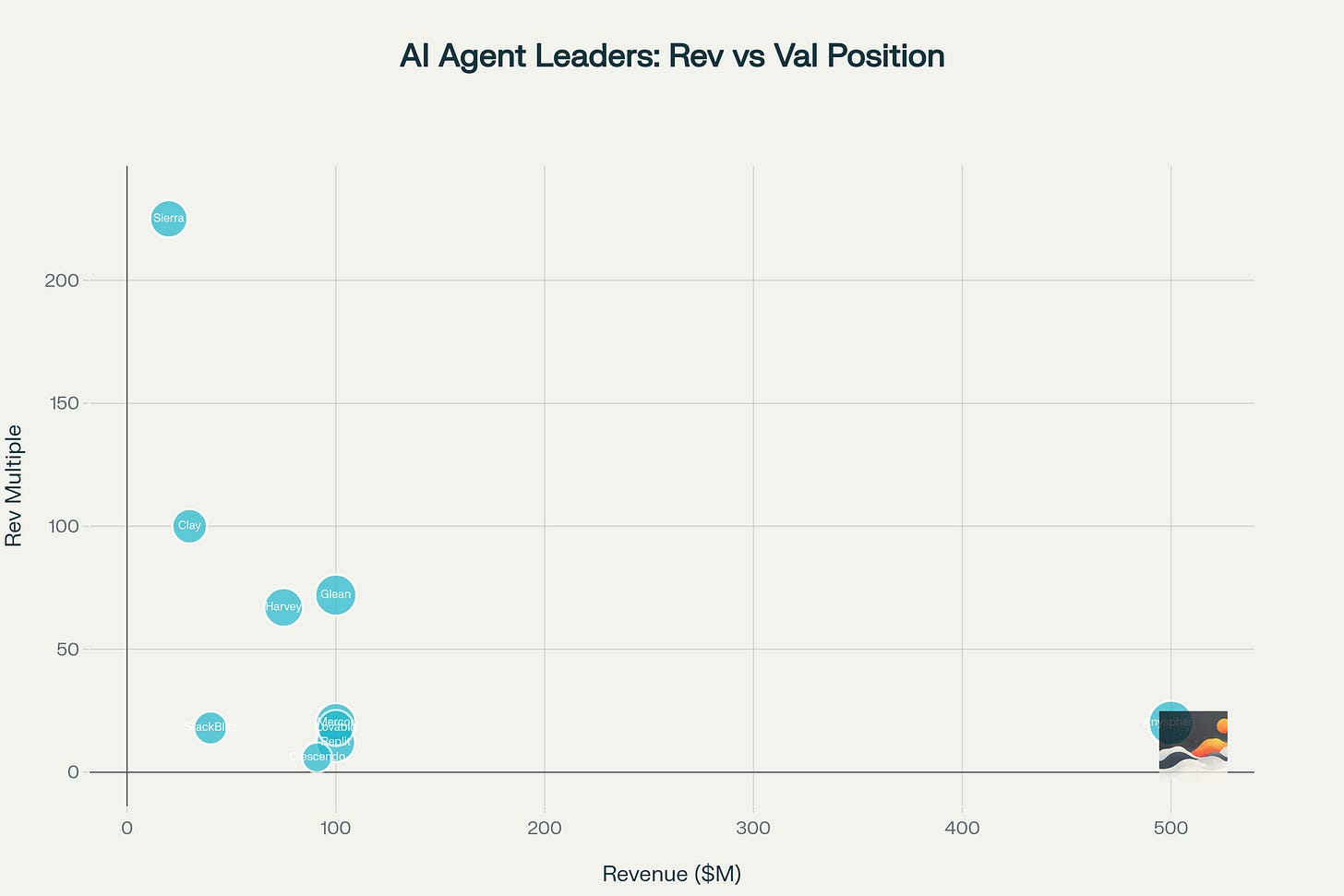

Valuation Metrics and Revenue Multiples

The valuation landscape for AI agent startups defies traditional software-as-a-service benchmarks, with companies commanding revenue multiples averaging 52.5x compared to typical SaaS multiples of 7-10x. The median revenue multiple stands at 22.5x, while outliers like Sierra achieve extraordinary 225x multiples, reflecting investor confidence in exponential growth potential.

Market Dominance and Sector Distribution

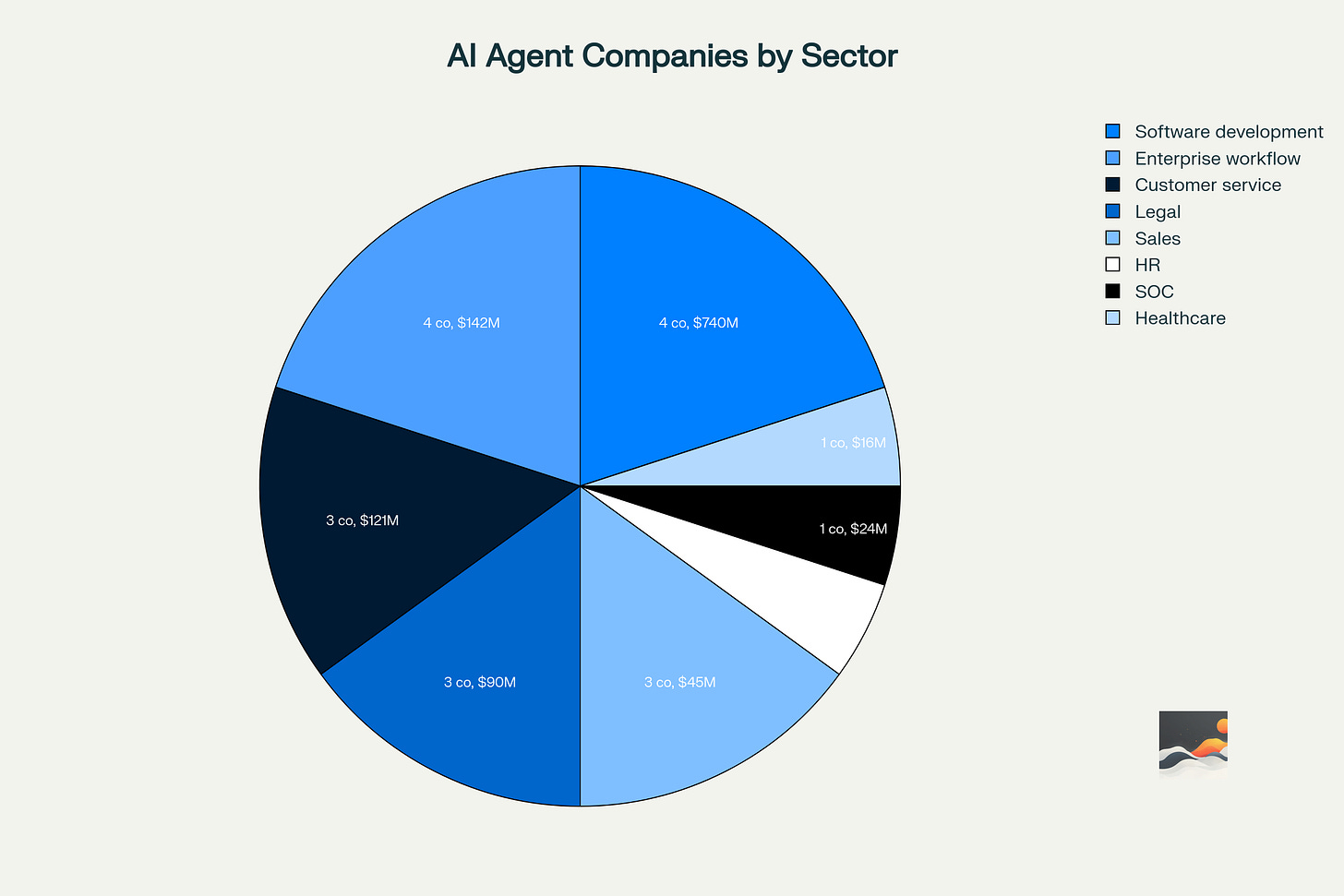

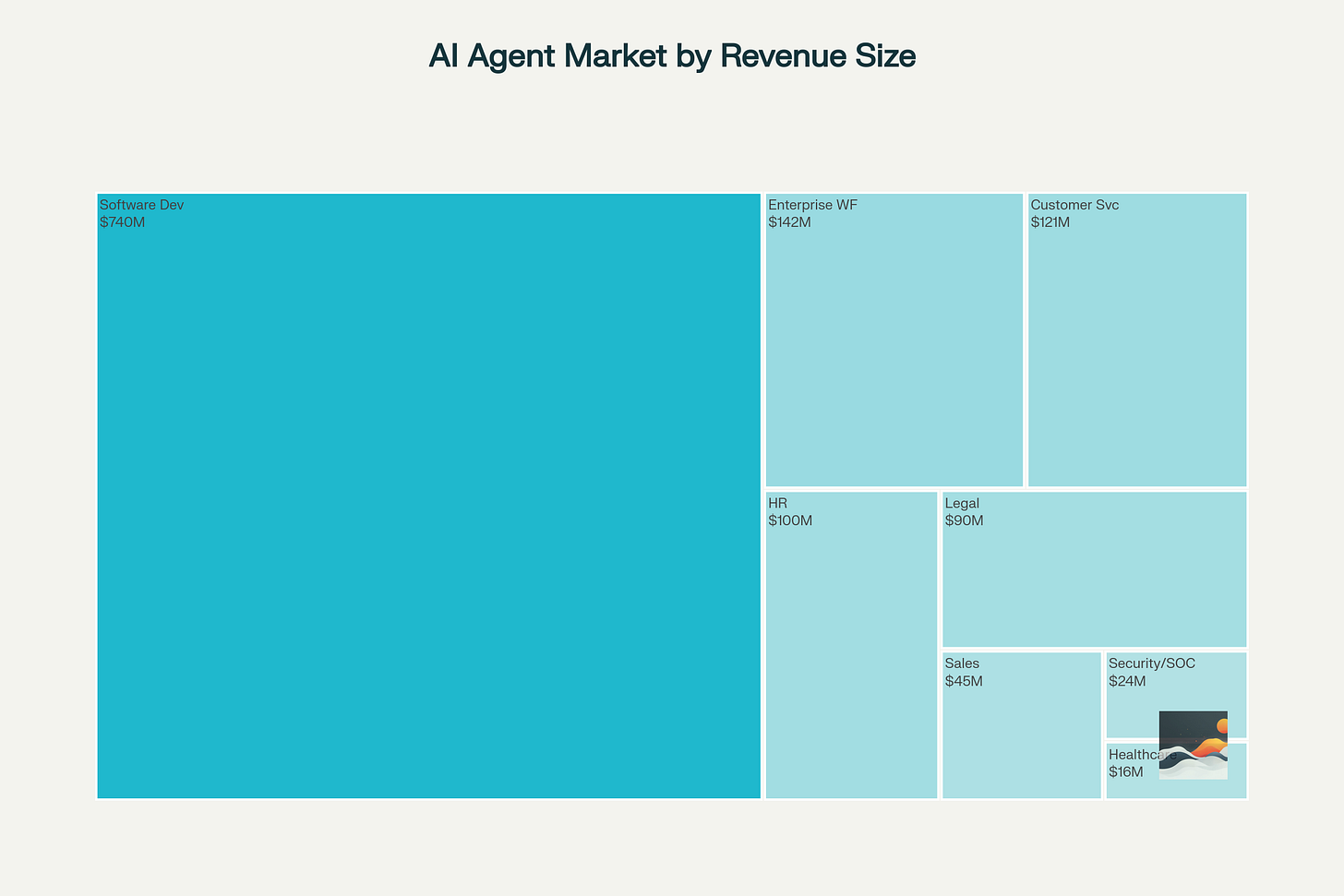

With software development tools capturing the largest share of both company count and revenue generation, the AI agent startup ecosystem exhibits clear market concentration patterns.

The sector analysis reveals that four companies in software development collectively generate $740 million annually, representing 58% of the total market value among the top 20 startups. The geographic distribution remains heavily concentrated in North America, with the United States capturing approximately two-thirds of global AI agent venture capital investment in 2025. UK AI startups secured $2.4 billion in venture capital funding in the first half of 2025, representing 30% of all UK VC activity and demonstrating the global nature of this market expansion.

Enterprise workflow solutions represent the second-largest category with four companies generating $142 million combined, followed by customer service applications with three companies producing $121 million in annual revenue.

Industry Applications and Use Cases

Software development dominates the AI agent landscape with $740M in revenue, representing 58% of the total market, while enterprise workflow, customer service, and other applications create a diversified ecosystem with varying revenue potentials.

Software development applications represent the most mature AI agent market, with companies like Cursor, Replit, StackBlitz, and Lovable achieving significant revenue milestones through code generation, debugging, and full-stack development automation. The coding AI agents market has shown particularly impressive momentum, with companies achieving unicorn status in as little as six months—four times faster than the AI industry average.

Enterprise workflow automation encompasses broad applications including document processing, knowledge management, and business intelligence. Companies like Glean, Sana, and Hebbia provide AI-powered search, analysis, and content generation capabilities that integrate with existing enterprise systems while maintaining security and compliance requirements.

Customer service AI agents are transforming support operations through autonomous conversation management, ticket resolution, and customer interaction handling. Sierra, Crescendo, and Decagon demonstrate how AI agents can manage complex customer relationships while reducing operational costs and improving satisfaction scores.

Legal technology applications show significant adoption among elite law firms and corporate legal departments, with Harvey leading the sector through specialized modules for contract analysis, legal research, and compliance monitoring. The legal services market represents a $300 billion opportunity in the United States alone, with analysts estimating 44% of legal tasks could eventually be automated.

Market Leaders and Strategic Positioning

Anysphere (Cursor) with users generating nearly one billion lines of working code daily, demonstrates the market demand for AI-native development tools

Glean’s Work AI platform connects enterprise data sources and enables intelligent search and automation. The company's 40% weekday daily/monthly active user ratio significantly exceeds the typical 10-20% seen in enterprise SaaS applications, indicating strong user engagement and product-market fit.

Harvey AI serving 337 legal clients including Fortune 500 corporations and elite law firms, demonstrates the legal industry's readiness to adopt AI-powered workflows for document analysis, contract drafting, and legal research.

Sierra Co-founded by former Salesforce CEO Bret Taylor and Google executive Clay Bavor, Sierra enables companies to deploy AI agents that handle complex customer interactions across multiple channels while maintaining brand consistency and compliance standards.

Revenue Efficiency and Operational Metrics

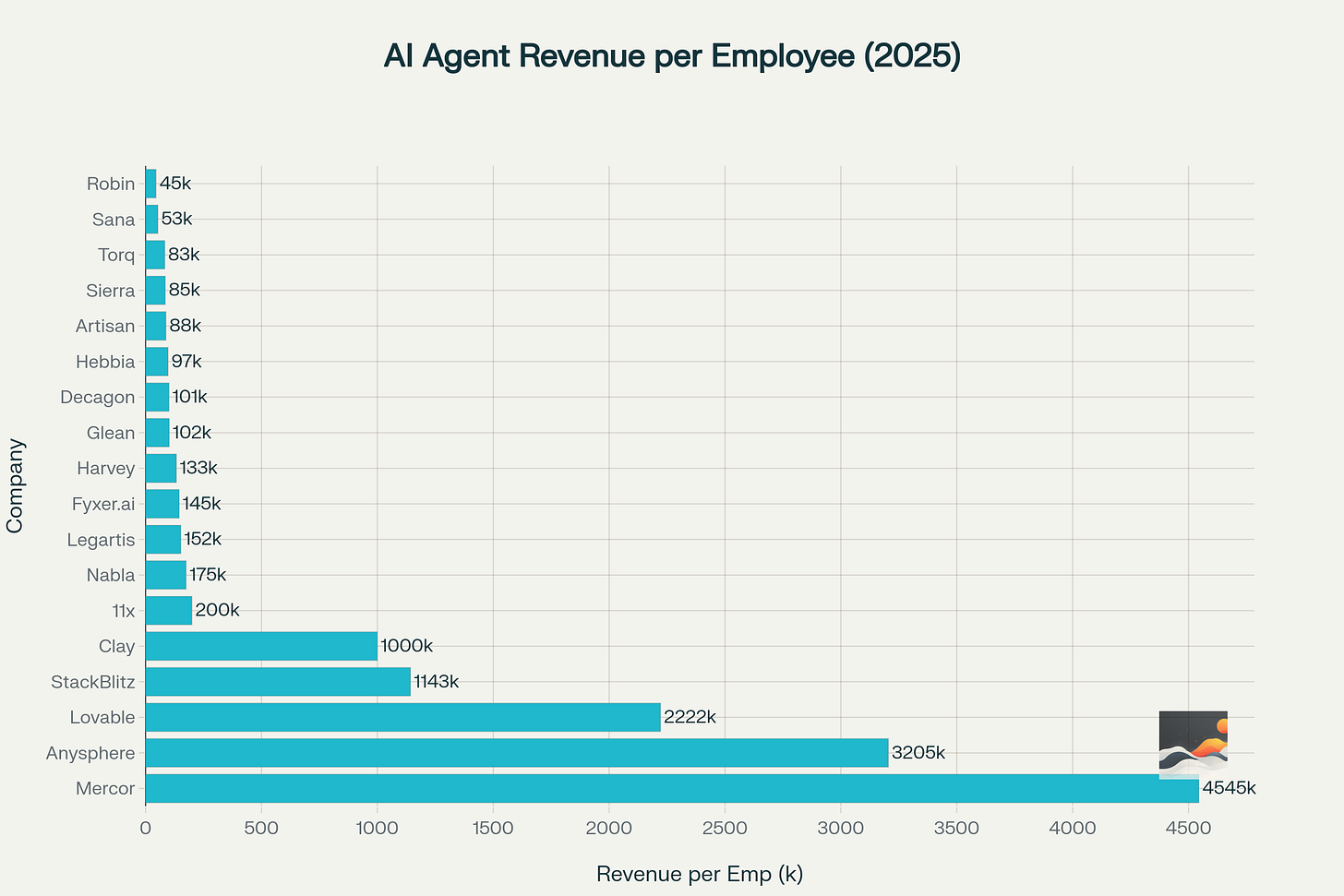

The revenue per employee analysis reveals extraordinary operational efficiency among top-performing AI agent startups, with significant variations reflecting different business models and operational approaches. Mercor leads with $4.55 million revenue per employee, followed by Anysphere at $3.21 million and Lovable at $2.22 million, demonstrating the scalability potential inherent in AI-powered solutions.

These efficiency metrics substantially exceed traditional software companies, where Microsoft generates $1.8 million per employee and typical enterprise software companies achieve $200,000-$500,000 per employee. The exceptional performance of AI agent startups reflects their ability to leverage automation and artificial intelligence to scale revenue without proportional increases in human resources. The median revenue per employee across the top 20 companies stands at $145,000.

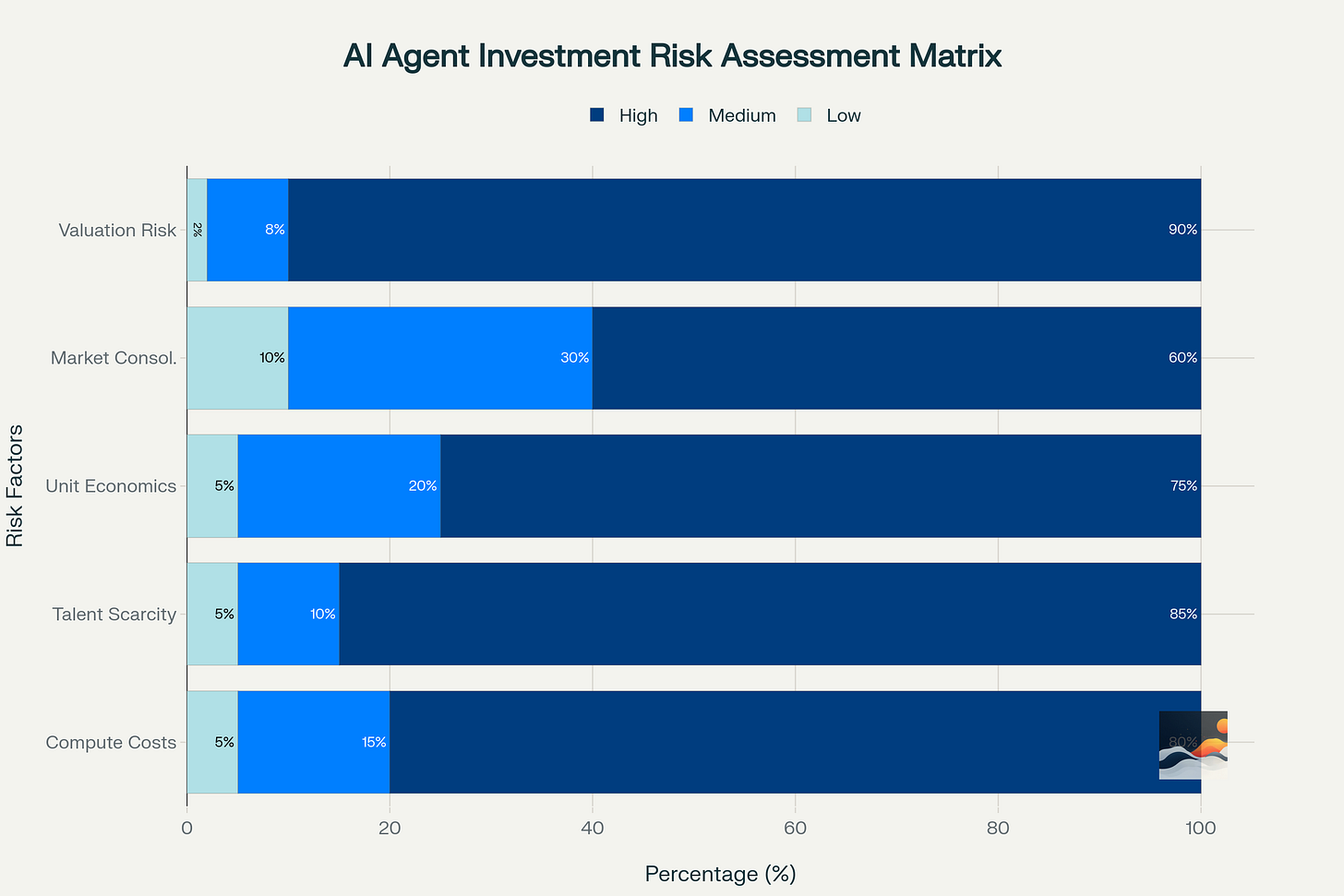

Investment Risk Factors and Market Sustainability

Despite remarkable growth metrics, the AI agent startup sector faces significant structural challenges including high compute costs, talent scarcity, and uncertain unit economics. Many companies operate with challenging cost structures that scale with usage, creating potential profitability pressures as they mature.

Revenue multiple sustainability remains a critical concern, with some companies trading at 200x revenue despite traditional SaaS companies averaging 7-10x multiples. This valuation gap reflects investor expectations of exponential growth rather than current financial performance, creating potential downside risk if growth trajectories normalize. also the concentration of venture capital among elite firms has created funding accessibility challenges for early-stage companies The recent acquisitions of Windsurf by OpenAI and other talent-focused transactions suggest that independent AI agent startups may face strategic acquisition pressures rather than long-term independence.

Investment Trends and Market Projections

The enterprise AI agents and copilots market has experienced explosive growth, expanding from $5 billion in 2024 to a projected $13 billion by the end of 2025, representing a 150% year-over-year growth rate. This expansion reflects both increasing adoption rates and the maturation of AI agent technologies across enterprise applications.

Venture capital investment in AI reached record levels in the first half of 2025, with $49.2 billion globally compared to $44.2 billion for all of 2024. The concentration of capital among mega-deals has created unprecedented funding availability for proven AI agent startups, while smaller companies face increased competition for early-stage investment.

Three additional markets are expected to reach $1 billion revenue milestones by end of 2025:

recruiting AI agents,

sales AI agents, and

customer service AI agents.

Future Outlook

The meteoric rise of AI agent startups marks a pivotal shift in the business and technology landscape, transforming once-theoretical possibilities into billion-dollar realities at unprecedented speed with AI agents startup now leading the charge, redefining productivity, customer experience, and even the nature of work itself. At the same time the flood of new entrants since 2023 highlights both how quickly fortunes can be made—and how quickly competition ramps up.

Looking ahead, AI agents are set to become a fixture in enterprise infrastructure, with market size projected to reach $13 billion by the end of 2025 and ever-increasing relevance moving forward. The transition from growth-at-any-cost to sustainable value will define the next wave, favoring those who blend relentless innovation with operational rigor and strong moats.

Key Lessons for Founders

Focus on Sustainability as Early as Growth: Hyper-growth is exhilarating, but long-term success depends on mastering unit economics, customer retention, and defensible differentiation.

Prepare for the $100M Plateau: Many AI startups hit a ‘speed trap’ at $100M revenue. Anticipate operational scaling, profitability pressures, and the need to prove your business model works at scale.

Embrace Rapid Learning and Adaptation: The rules for AI are being rewritten in real time. Founders must constantly learn, iterate, and adapt to shifting market, technical, and talent realities.

Build Real Moats: Domain expertise, technical defensibility, and superior customer experience are the foundations for surviving market consolidation and emerging as a true leader.

Don’t Chase Growth Blindly: In the new market phase, sustainable value and judicious execution trump blitzscaling. The companies that endure will be those that balance strategic ambition with operational discipline.

If you enjoyed this post, do like, subscribe and share this on your favorite channel.

Further reading :

Bandwidth & Broken Hearts: How Telcos Became the Unrequited Lovers of the Digital Age

Wiring the Future: AI, Chips, and the Race to Reinvent the Internet

AI’s Gold Rush 2.0: Unpacking the Psychology, Power, and Paradoxes Shaping Billion-Dollar Bets

Why Tech Journalism Is Now the Most Powerful Beat in the Newsroom

Project Trillion: UK's 10-Year Race to Reshape Global Technology