AI’s Gold Rush 2.0: Vibe Valuations, Founders Pedigrees, Lessons, Warnings, and Wild Bets

Unpacking the Psychology, Power, and Paradoxes Shaping Billion-Dollar Bets. Decoding AI’s Unconventional Valuation Boom, The New Era of AI Startup Investments : Bubble or Breakthrough?

In a recent LinkedIn conversation with Adarsh Lathika, as we reflected on the momentum driving the AI wave: enterprises chasing trends without clear ROI, startups leaning heavily on hype, and investors doubling down on bold, often unproven bets, I couldn’t help, but notice: the kicker—from my front-row seat as a founder, it sometimes feels like we’re all in a game whose rules keep changing.

Everywhere you look, companies are racing to adopt AI—not necessarily because it drives value, but because no one wants to be left behind. Enterprises feel the pressure to “do something AI,” regardless of ROI clarity. Startups ride the hype wave, often using buzzwords like “AI-everywhere” to stay relevant. And behind much of this momentum, venture capitalists are pouring billions into the space, betting big on trends and hope over proven outcomes.

So while it’s tempting to see this as just another innovation boom, the cracks are showing. Is this momentum driven more by pressure than purpose? Could the biggest players fueling the AI fire end up burned? Is FOMO driving more decisions than strategy. Are we actually innovating, or just riding a hype cycle. maybe the real plot twist is that venture capitalists. with their wild portfolios, end up as the biggest losers if this AI gold rush fizzles out. Or Maybe, just maybe, it’s time for a reality check to see who really comes out on top—and who might be left holding the bag. Let’s explore this in depth:

“Vibe Valuation” in Generative AI Startups

Vibe valuing a term coined by The Economist in their June 25, 2025 feature, is the ability of venture capitalists to conjure up vast valuations for AI startups with scant regard for old-school spreadsheet measures like cash burn or ARR. the discussion and some of the examples that followed from it on linkedin, were interesting to say the least.

To begin with, the scale and speed of capital flowing into AI seemed unprecedented, with investors often betting on founder pedigree and vision rather than proven business fundamentals. for example:

Thinking Machines Lab: Raised $2B at a $10B valuation, despite having no public product or revenue.

Perplexity: At the time of its $14B valuation, had $34M in revenue and $65M in burn, equating to a valuation over 400× revenue—far above the ~6.5× multiple typical for public SaaS companies. Later comments updated Perplexity’s revenue to $100M+.

Cursor (Anysphere): Raised $900M at a ~$10B valuation as an early-stage code-generation company, with later claims of $500M ARR.

The macro trend of skyrocketing valuations in generative AI sparked a good live debate and the reactions and surfaced key insights that warranted attention:

Fact-Checking and Data Updates:

Several participants challenged the original figures, especially for Perplexity and Cursor, providing more recent or higher revenue numbers and emphasizing the importance of up-to-date, accurate data.Founder Pedigree as a Key Driver:

Many agreed that investments are often made based on the reputation and track record of founding teams, especially those with prior success in AI (e.g., ex-OpenAI leadership).Historical Parallels:

Comparisons were drawn to past industry bubbles, such as telecom in India, where heavy early investment led to consolidation and significant losses for most players.Skepticism and Caution:

Some commenters warned of a potential bubble, noting that gravity eventually catches up with inflated valuations and that most startups historically fail in their early years.Contrasting Approaches:

The discussion also highlighted companies like Surge AI, which reportedly achieved $1B in revenue without any VC funding, showing a different path to success.Diverse Investment Rationales:

Others noted that each business is unique, and direct comparisons are difficult; investors may have a variety of reasons for backing high-valuation startups.

I wanted to dig a bit deeper in to the telecom parallel, so I looked up.

In the late 1990s (around 1996-97), India opened its telecom sector to private players. At the outset, there were 12-13 well-funded companies entering the market, each investing heavily in capital expenditures (CAPEX).

Outcome:

Despite the initial influx of capital and competition, only three companies survived in the long run, with one reportedly still struggling ("in ICU"). The majority of the early entrants failed, resulting in significant financial losses for shareholders, the government, and investors.Lesson Drawn:

The commenter suggested that the pattern of heavy early investment followed by consolidation and widespread losses is not unique to AI. The telecom example serves as a cautionary tale: large amounts of capital and hype do not guarantee sustainable business success. The cycle of over-investment and subsequent failure is a recurring theme in new, high-potential industries.The comparison was used to highlight that while AI is a promising field, strong investment fundamentals and a focus on real market needs remain crucial. History shows that speculative bubbles can lead to significant losses if not tempered by careful analysis and realistic expectations.

Together, these insights reflect both the optimism—and the caution—surrounding generative AI’s investment boom, underscoring the need for balanced perspectives and rigorous due diligence going forward. The debate is a healthy nonetheless, At this early stage its crucial to understand whether these “vibe valuations” are justified or if they signal a speculative bubble that could eventually burst. The current wave of AI investment is driven more by potential, vision, and founder reputation than by traditional financial performance and this conversation underscores the need for accurate, up-to-date data and skepticism toward media reports that may lag behind industry realities.

Why VCs Are Pouring Money Into AI

The current AI investment frenzy isn't just about technology—it's driven by a perfect storm of psychological and economic factors that’ll create massive opportunities for savvy founders who would understand the game.

The Fear-Driven Investment Machine

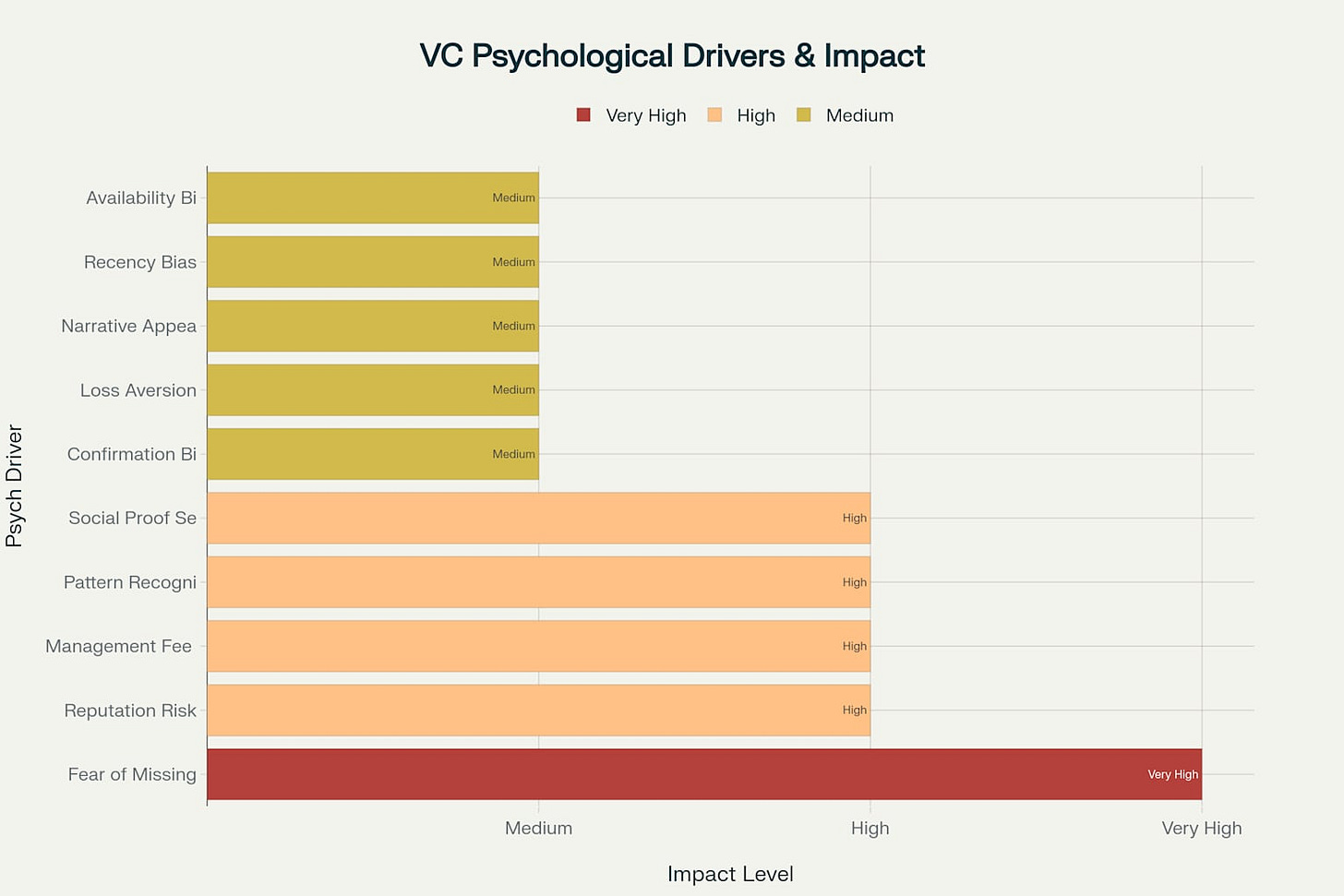

Two powerful psychological drivers that are reshaping the entire investment landscape:

AI FOMO (Fear of Missing Out) has reached unprecedented levels, with 57.9% of global VC dollars flowing into AI startups in Q1 2025 alone. This isn't rational analysis—it's panic-driven decision making where VCs fear being left behind in what many consider the biggest platform shift since the internet.

FOLS (Fear of Looking Stupid). VCs know that missing the next OpenAI or Anthropic could end careers, while investing in a failed AI startup can be explained away as "betting on the future." This creates a powerful asymmetric risk profile that heavily favors AI investments, regardless of traditional metrics.

The Math That Broke Everything

Venture capital runs on a simple "two and twenty" formula—VCs collect 2% annual management fees plus 20% of profits. Sounds straightforward, right? Critically, 95% of VCs never actually turn a profit, meaning they're essentially living off those management fees alone. A $100 million fund? That's $2 million flowing in annually, whether they back the next Google or fund spectacular failures.

This creates perverse incentives where VCs prioritize raising larger funds (bigger fees) and making headline-grabbing investments over actual returns. Ever wonder why every VC suddenly sounds like an AI evangelist?

When Fees Matter More Than Returns

What happens when your survival depends on management fees rather than picking winners? You start prioritizing bigger funds over better investments. Why stress about spreadsheets when you can raise a $500 million fund and guarantee $10 million in annual fees?

This creates the perfect storm: VCs now hunt exclusively for "extraordinary businesses" promising 10x-100x returns—not because these are better bets, but because that's the only math that justifies their existence.

The "Vibe Valuation" Era & The Real Question

Enter the most curious phenomenon in modern finance: traditional metrics are out, vibes are in. Annual recurring revenue? Burn rates? How quaint.

What matters now is founder pedigree, AI positioning, and whether the business feels like it could scale to the moon. It's as if an entire industry decided that actual business fundamentals were too boring for their ambitions. Makes you wonder what amazing technologies we're missing simply because they don't sound extraordinary enough for someone's fund math, doesn't it?

Here's what keeps me curious: when 95% of the people deciding which technologies get funded can't generate profits themselves, should we really trust them to pick the innovations that shape our future?

The Psychology Behind VC Decision-Making

VCs are not purely rational decision-makers—they operate under specific psychological drivers, economic pressures, and market dynamics that significantly influence their investment choices.

Pattern Recognition and Cognitive Biases

VCs rely heavily on pattern recognition, looking for familiar signals that indicate success such as market size, traction, and team credibility. Once they form an initial impression, confirmation bias leads them to seek supporting evidence while discounting contradictory information.

Current Market Dynamics Affecting VC Behavior

The 2025 venture capital landscape presents unique opportunities and challenges that directly impact how VCs make investment decisions. Global VC funding reached $91.5 billion in Q1 2025, representing an 18.5% increase from the previous year, signaling market recovery from the 2022-2023 downturn.

Valuation Environment

Current market conditions show significant valuation disparities:

VC-backed startups trade at >30x revenue multiples based on growth potential

Private SaaS M&A averages 4.2x revenue multiples

Public SaaS companies trade at 4.8-5.0x revenue multiples

This means VCs are willing to pay substantial premiums for companies they believe can achieve massive scale, particularly in AI infrastructure.

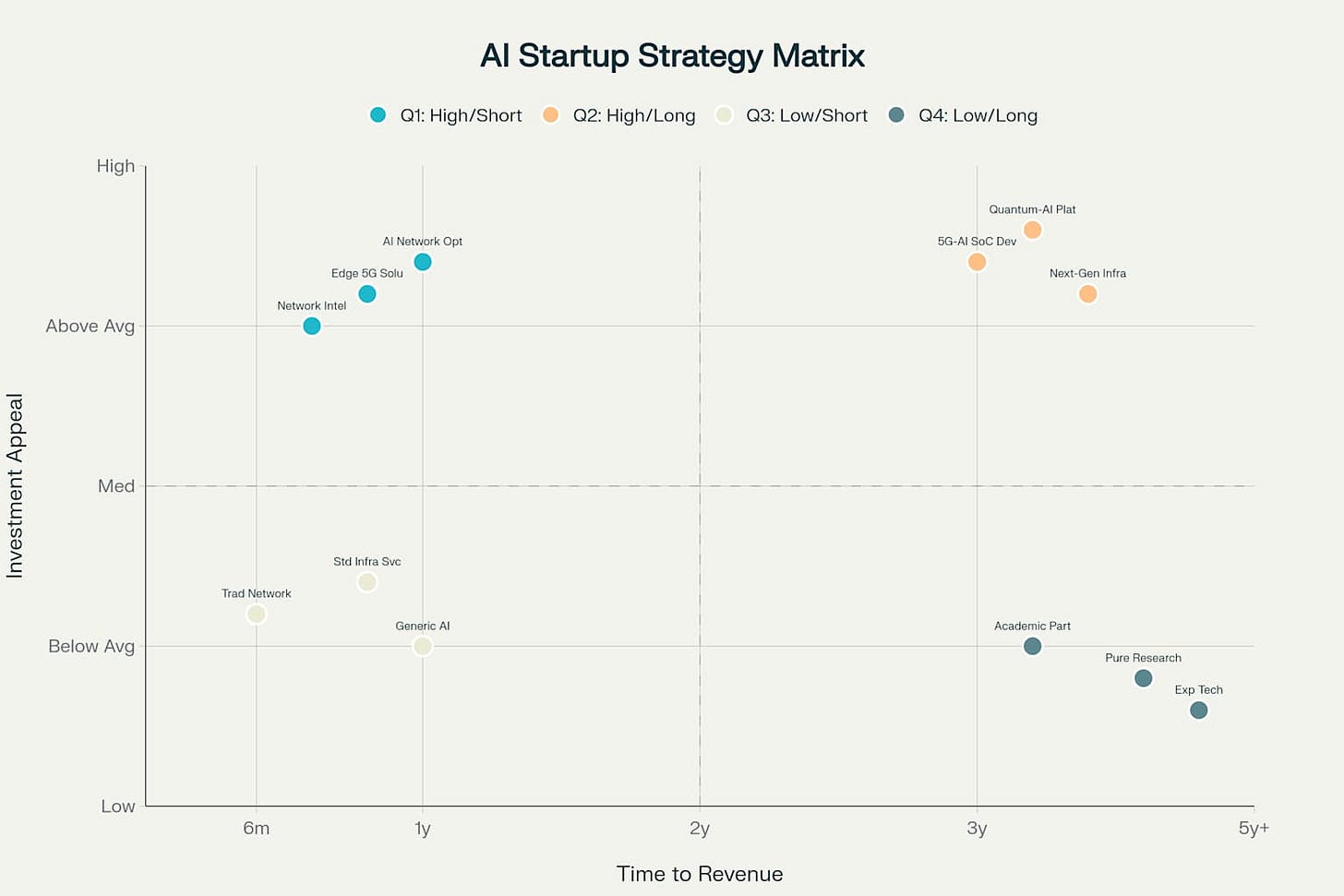

AI infrastructure that enables everything else : Leveraging the Opportunity

So what could be one of the most compelling investment categories for VCs? Would bandarlog.dev be attractive enough to these VCs? I thought i’d look in to it from my own startup’s focus and positioning—Our focus is core network infrastructure which is not exactly AI infrastructure but supports it and is supported by it. this means, on a broader level I am in long-term looking in to everything from On-device AI, to semiconductors, quantum network optimizations, future business applications and services.

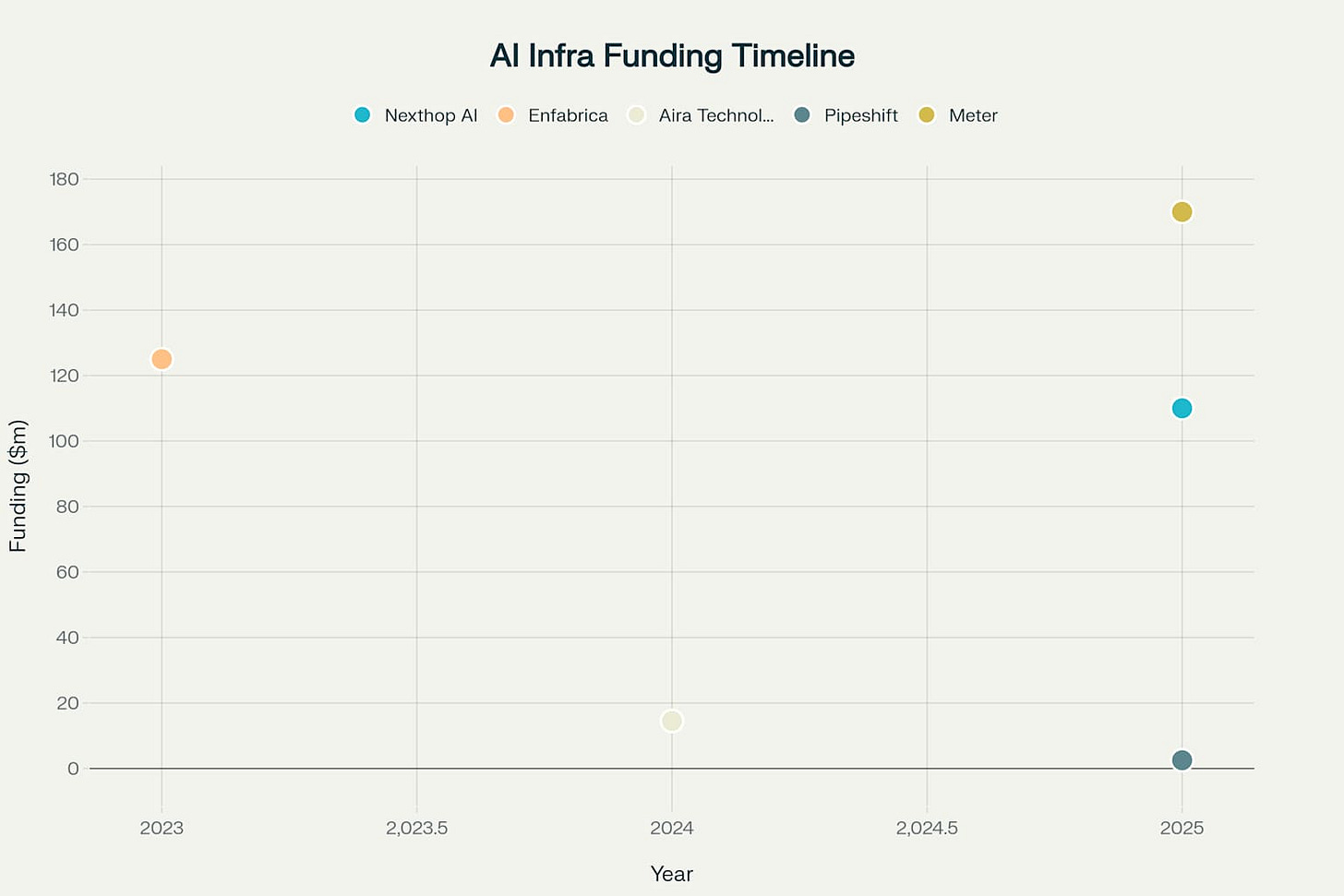

The current market presents unique timing advantages:

AI infrastructure is underfunded relative to applications (supply/demand imbalance)

5G buildout is creating massive infrastructure upgrade cycles

Edge computing requirements are exploding with AI workload growth

Quantum computing is moving from research to commercialization

The key insight is that VCs are betting on picks and shovels, not just gold miners. While application-layer AI companies face brutal competition, infrastructure providers can capture value across the entire ecosystem. Infrastructure investments have historically produced the largest returns in technology platform shifts, and VCs know this. a quick revenue strategy is crucial for de-risking the investment for VCs which means focussing on:

Immediate value capture: Network optimization services using your AI algorithms

Proof of platform potential: Edge AI deployments that demonstrate scalability

Customer development: Building relationships with the telecom and cloud providers who will be your future SoC customers

So does this align with current VC psychology? Perhaps, I could tell a better story. The key is to position yourself not just as another AI company, but as the critical infrastructure that enables the AI future VCs are desperately trying to fund. Remember: VCs aren't just investing in technology—they're investing in their own career success and fund performance. So, Instead of saying "we make networks better with AI," I’d say "we're building the neural pathways for the next generation of connected intelligence." enablement over optimization. less incremental, more transformational.

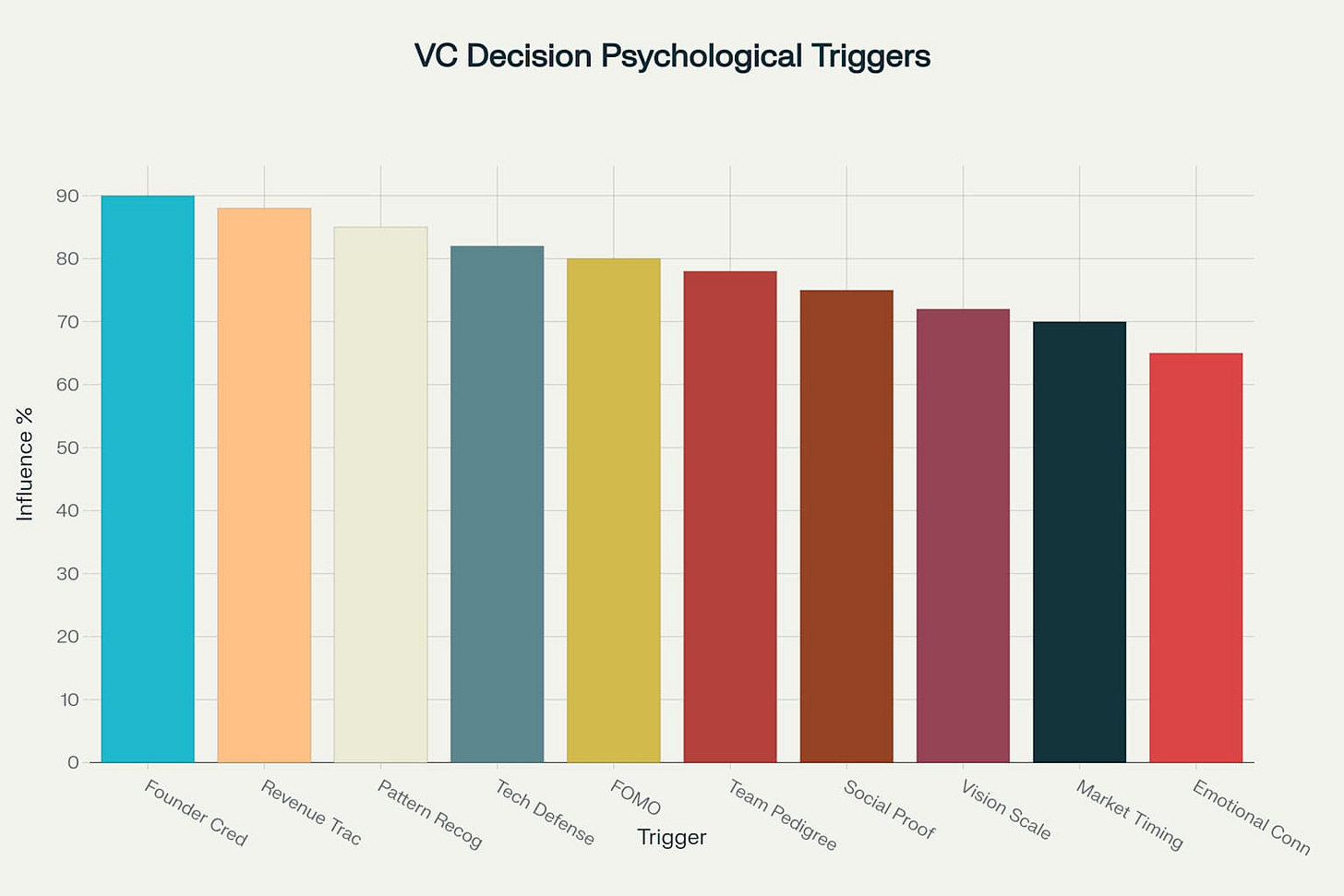

What Storytelling Strategies Resonate Most with VCs to Boost startup Funding Chances

Understanding how to craft a compelling narrative is crucial for securing venture capital funding, especially in the competitive AI infrastructure space. The key is to remember that VCs are human beings making decisions under uncertainty and pressure. VCs make investment decisions based on both rational analysis and emotional connections, making storytelling a critical skill for founders seeking funding. the graph below presents the key and the most effective storytelling strategies that resonate with the VCs:

VCs typically make tentative investment decisions within the first 20 minutes of a pitch meeting. This compressed timeline means founder’s story must immediately capture attention and build conviction quickly. The most successful founders understand that VCs are pattern-matching against previous successes while simultaneously seeking breakthrough opportunities that defy conventional patterns

Core Storytelling Frameworks That Drive Investment Decisions

The most effective startup pitches follow a clear narrative progression that mirrors classic storytelling structures. Start with a compelling problem statement that creates emotional resonance, then present your solution as the inevitable answer, and finally demonstrate the transformative impact your technology will deliver.

Successful VC storytelling combines emotional resonance with logical proof points, leveraging psychological triggers while demonstrating clear paths to massive outcomes. The key is authenticity— Focusing on enabling the AI future rather than just participating in it, and structuring the story to make VCs feel they're getting early access to essential infrastructure for the coming AI transformation.

Positioning an AI Startup for Dual Appeal: A Strategic Framework for VCs and Founders

Dual positioning means crafting your AI startup’s story to appeal to both VCs and founders. It boosts funding chances, builds ecosystem credibility, and balances growth with technical trust. By aligning with investor goals and developer needs, you create a more resilient, scalable, and partnership-ready business for today’s competitive AI landscape.

The strategic positioning matrix above reveals that the most successful AI startups occupy the upper-right quadrant, achieving high appeal to both VCs and Founders simultaneously. This "sweet spot" positioning requires careful balance between commercial viability and technical excellence.

I hope you found this article interesting, informative, and useful. Do like subscribe, share it with you colleagues and friends and on social media — X, LinkedIn, or the platform of your choice.

Ok. I read in detail today. It is also my hypothesis that vc will be the biggest losers in the game of AI. A better analogy will be investment in edtech in India as against telecommunication.

i skimmed through this Poonam - i will come back to read this in detail.

Interestingly enough, I took a different angle based on our conversation and thought if professionals with experience are better positioned to build successful startups in AI. I wrote that here - https://www.linkedin.com/pulse/india-crossroads-can-mid-career-innovators-drive-next-s-lathika-klnbc/

adarsh