Network Automation: where we're now!

From conference rooms to reality, reviewing the last 5 years of chatters, implementation, strategies and future direction.

I started my career with Network automation at Cisco over 2 decades ago. my focus area was more script based automation for ( dev-test) routers and switches for MPLS Networks. from there I moved to production side in AT&T and Verizon and then to Keysight to selling testing and network monitoring solutions. when I founded my started bandarlog.dev in 2021, in UK, which was relatively a new tech landscape for considering I haven’t been to Europe much until, I wanted to understand how we plan to transform the legacy infrastructure to something that can handle next generation applications and services including metaverse who no one wants to speak about anymore except yes, there are groups working in peace on this, including me, with in a small bandwidth and scope.

the telco industry’s journey in past few years has been marked by intense activity. good or bad, some success here and there but a lot of technological disruption. in 2022-23 every other conference was focussed on Network automation, before that we were busy talking about how 5G is gonna change the world. then came Gen AI and all hell broke lose, literally. Disruption is good though. no seriously. but distraction? not really.

so now at the end of 2025 when we’re slightly more settled in the Gen AI space, and figuring out how Agentic AI and distributed architecture may be the future, I wanted to assess where we are in terms of our main goal and thats infrastructure.

TL;DR

Industry focus on Network automation in past 5 years.

Have we just been talking? How much automation has been achieved since.

has AI accelerated the efforts or been a distraction?

What’ is actually blocking progress, what are the biggest challenges.

What should be our roadmap

for Non-networking people » Automation comes in different flavors for example factory robots that build things, software “robots” (RPA) that click through computer screens like a person would, and workflow automation that handles business tasks like approving expense reports.

Network automation at the basic is what manages your internet equipments, the hardware - it automatically configures and fixes routers, switches, and firewalls that keep networks running. This is not workflow automation which handles paperwork, RPA mimics human clicking, but network automation actually controls the invisible infrastructure that makes the internet work - it’s managing the Infrastructure, not just the tasks.

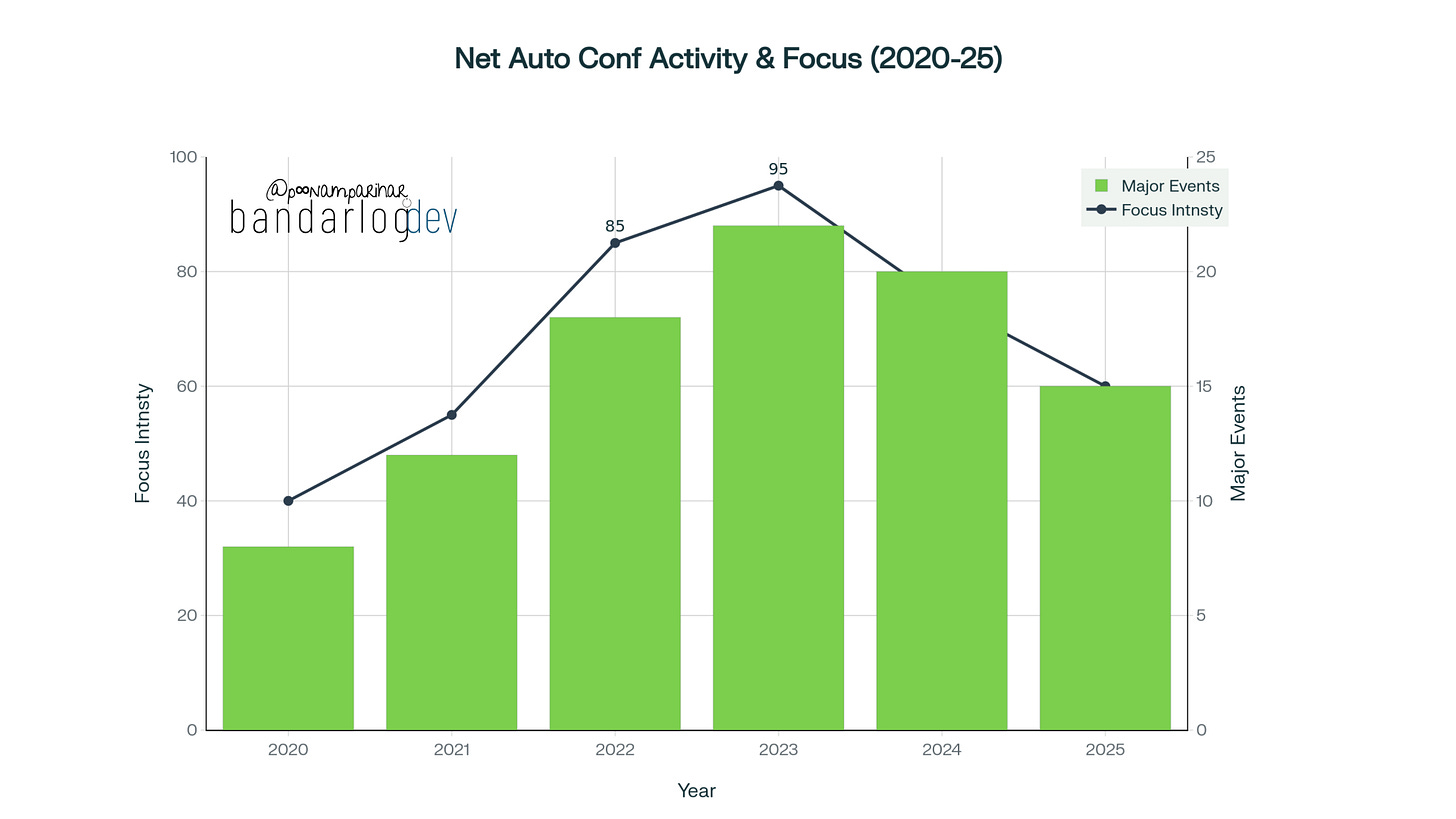

1. The boom in Network Automation Conferences

The last 5 years have witnessed a dramatic arc in network automation conference activity and industry focus, with a clear peak that tells us much about where the industry has been and where it’s heading now. the most number of conferences focussed on Network automation were in 2022-2023, with lot of industry mobilization around automation themes. In 2022, 18 major events focused heavily on network automation, with a focus intensity score reaching 85 out of 100. This number surged to 22 events in 2023 with peak focus intensity of 95, representing the high-water mark of pure automation-focused gatherings.

Mobile World Congress Barcelona 2022 epitomized this peak, dedicating substantial programming to 5G expansion and network transformation. in the same year, specialized events like Cisco’s “Automate & Innovate 2022” concentrated almost exclusively on integrated network automation and intent-based networking. The 2023 conference season maintained this momentum. MWC Barcelona 2023 pivoted toward cloud-native networks, 5G Standalone architecture, and network automation with a focus score of 92. NANOG 88 in June 2023 presented critical data from the “2023 State of Network Automation Survey Results,” while the GSMA Digital Transformation Leaders’ CxO Summit in November 2023 in Kuala Lumpur brought together industry executives to discuss intelligent digital transformation in the 5G era.

Then comes the shift:

While the absolute number of events remained substantial (20 in 2024, 15 in 2025), the focus intensity dropped markedly to 75 and 60 respectively in past 2 years. AI took the center stage and focus dropped to almost 50. all the major events such as DTW Copenhagen 2024, Network X Paris 2024 and FutureNet World 2025 demonstrated the new reality with automation focus at 55 versus AI focus at 90.

Several converging factors could explain why network automation may have first dominated the conference landscape during this 22-23 and then the drop afterwards.

5G Deployment Momentum: Global 5G connections surged from 1.05 billion in 2022 to 1.5 billion in 2023, a 43% increase in a single year. The number of commercial 5G networks expanded from 229 to 259, each requiring sophisticated automation for network slicing, dynamic resource allocation, and service orchestration.

Market Validation: The network automation market experienced explosive growth from USD 2.99 billion in 2022 to USD 14.56 billion in 2023, an astonishing 387% year-over-year increase. This validated the business case and attracted intense industry attention and investment.

Technology Maturity: By 2022-2023, SDN/NFV had matured sufficiently for widespread deployment. Over 140 telecom operators across 70 countries had implemented SDN or NFV by 2022, growing to over 70% of communication service providers adopting cloud-native network functions by 2023.

Legacy Infrastructure Urgency: The PSTN shutdown timelines became critical, with the UK’s BT Openreach announcing a complete shutdown by January 2027 and nationwide stop-sell beginning September 2023. Operators faced mounting pressure as 60-80% of IT budgets were consumed maintaining legacy systems, creating existential urgency around modernization.

Pre-GenAI Clarity: Importantly, 2022-2023 predated the GenAI revolution triggered by ChatGPT’s November 2022 release. The automation discussion remained focused on achievable, well-understood technologies rather than speculative AI capabilities, creating clearer messaging and stronger industry alignment.